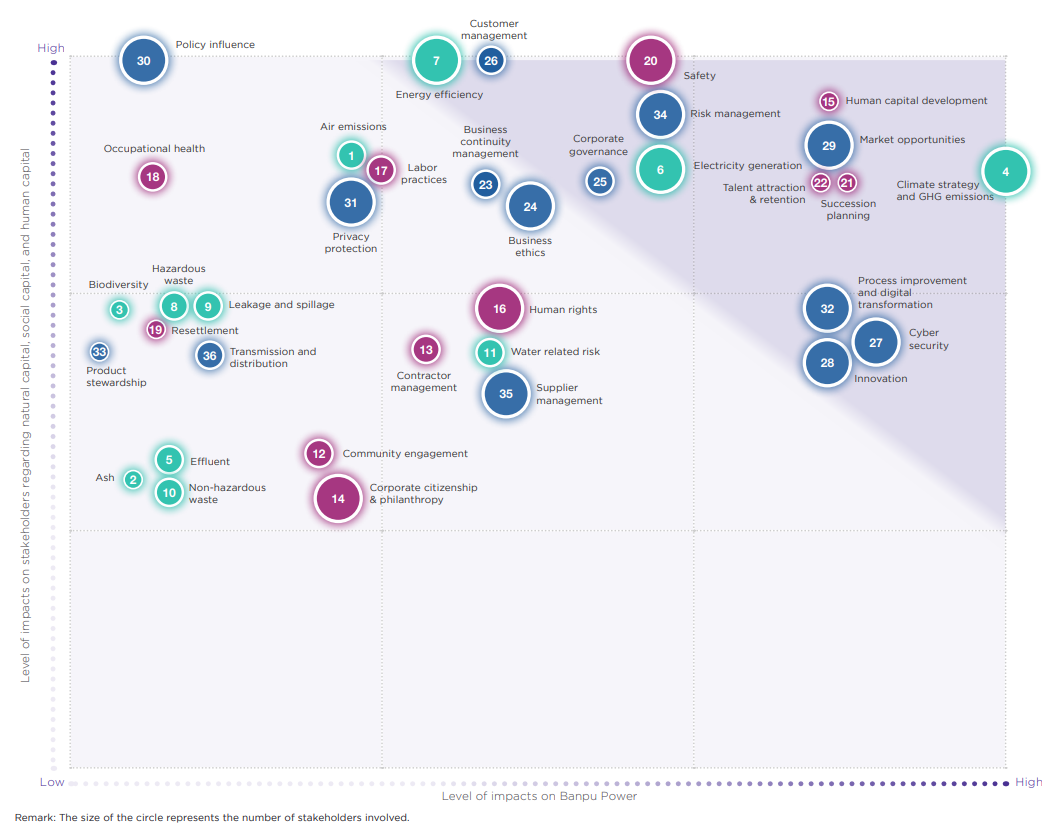

BPP assesses the sustainability materiality associated with its businesses in order to prioritize the short- and long-term materiality and set up the sustainable development strategies and targets for the years 2021 – 2025 in accordance with the “Beyond Quality Megawatts” strategy. Subsequently, the operational plan and proper indicators have been developed, while the sustainability progress has been monitored and evaluated regularly by various parties, ranging from business units, the Sustainability Committee, the Risk Management Committee, the Environment, Social and Governance (ESG) Committee to the Board of Directors. In addition, the external assessment results from both national and international agencies are also in consideration for developing improvement plans and raising BPP’s sustainability performance standards, responding to endless changes, and meeting the international standards as well as stakeholders’ expectations completely.

BPP’s major sustainability materiality is assessed in accordance with the Global Reporting Initiative (GRI) and AA1000 AccountAbility Principles (AA1000AP). The materiality prioritization has been considered based upon its significance on BPP and stakeholders covering the ESG issues annually.

Sources of sustainability materiality include:

- Major enterprise risk issues derived from corporate risk management systems.

- Trends or directions of changes in the energy business.

- Applicable laws and future change trends.

- ESG practice guidelines and ESG operation standards.

- Practice guidelines, best practices of power business and others associated.

Materiality Assessment Process

1. Identifying sustainability-related issues by studying from various sources and stakeholder’s engagement and thoroughly compiling business-associated issues, including stakeholder’s expectations, key enterprise risks, and changes arising all around, such as:

- Risk assessment results derived from the Enterprise Risk Management System, which collects risks from all business units and summarizes them as the organization’s risks every quarter

- International stakeholders expectations, such as sustainability performance questionnaires and financial institutions.

- The results of meetings with governmental agencies to clarify the projects and get advices

- The outcomes from meetings with joint-venture partners, regulatory agencies, consultants, suppliers, customers, and financial institutions to clarify the projects and listen to their opinions.

- The satisfactory survey results conducted with stakeholders who have jointly worked with BPP, consisting of joint-venture partners, regulatory agencies, consultants, suppliers, and financial institutes, via online questionnaires.

- The customer’s satisfactory survey result.

- Consequences of meetings arranged to update BPP’s operational progress and to listen to opinions, such as the shareholders’ meetings and the security analyst meetings.

- The results of following up on local and international policy trends, legislation, and ESG expectations.

- Sequels of employee engagement survey, and “Banpu Heart” corporate culture scores, including employee feedbacks gained from the online surveys carried out by external consultants and a focus group conducted within the organization.

- Opinions gained from external consultants and experts.

2. Major Materiality Prioritization

2.1 Determining each materiality significance on BPP’s operations. The impact levels on BPP’s operations are evaluated in accordance with the corporate risk assessment criteria by appraising the impact assessment criteria in all 10 areas. Then, the highest impact will be used for prioritizing the significance levels of impact assessment criteria.

2.2 Identifying each materiality significance on stakeholders: The level of impacts on all stakeholders has been assessed by focusing on key stakeholders of each materiality affected by BPP’s operations both positively and negatively throughout the value chain. The impacts can be divided into 3 dimensions, including the effects on natural capital, social capital, and human capital, which have been integrated into human rights risks.

3. Evaluating core materiality by senior management in order to examine and provide opinions on improving key materiality assessment from a management perspective to cover the organization’s financial and strategic impacts, covering current and future operations.

4. Approving core materiality by the ESG Committee, which is the sub-committee at the Board level, responsible for governing the sustainability. The ESG Committee is comprised of 3 independent committees who have knowledge and working experiences outside the organization.

Additionally, the core materiality prioritization results have also been used for communicating and obtaining opinions from external experts/consultants to ensure a comprehensive and complete assessment.

Result from Materiality Assessment