Risk Management

Significance

Presently, various environments and situations are changing rapidly, with tons of uncertainties, such as economic fluctuations, regulatory changes or technological advancement, and increased expectations regarding environment, social, and governance (ESG). These factors inevitably affect business operations. As a result, risk management plays a key role in corporate governance. It is also an important mechanism BPP has used for operating its businesses to prevent losses and to stably grow in both strategies and investments.

In addition, risk management helps the project construction and production operations meet the set target and create sustainable values for stakeholders.

Management Approach

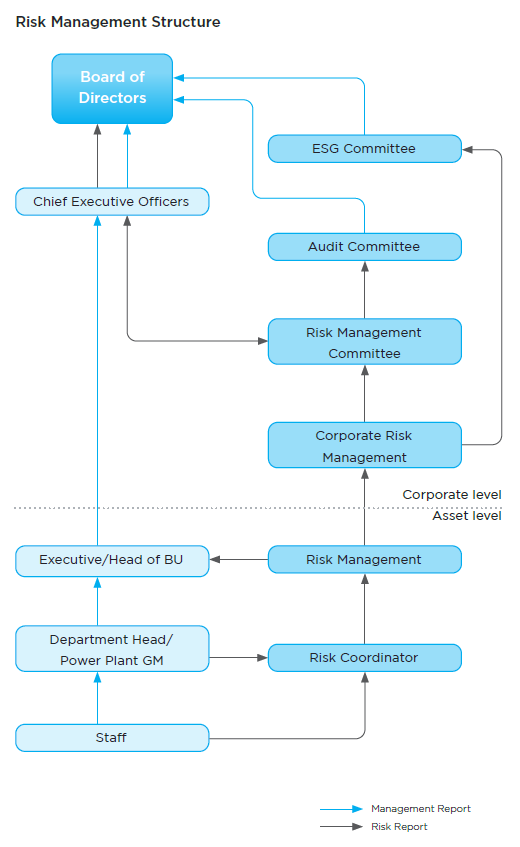

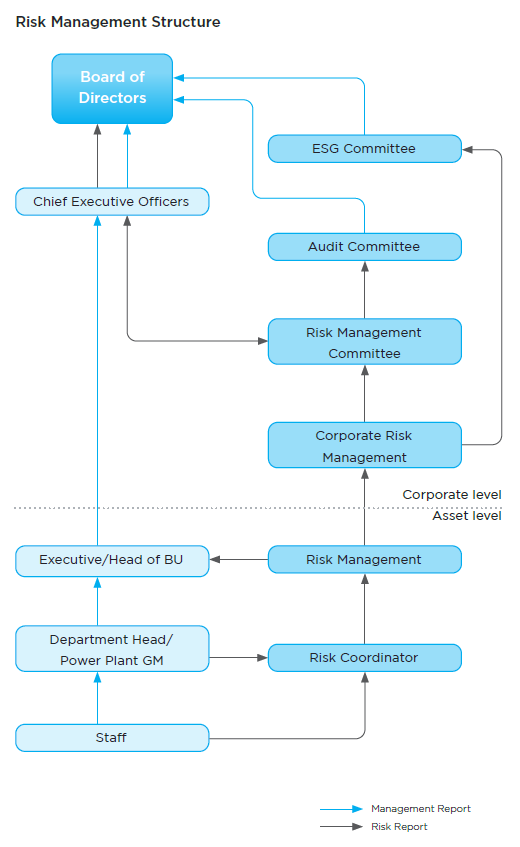

BPP’s risk management structure is divided into 2 levels, including the corporate level and the business unit level.

- Risk management at business unit level: For flexibility and being able to monitor various situations closely, a risk manager of each asset will analyze and assess risks of such an asset and report the risk management progress and performance to the “Sustainable Development and Risk Management” Department, responsible for compiling and summarizing each asset’s risks before submitting the findings to the Risk Management Committee.

- Enterprise risk management: The Risk Management Committee is playing a key role in enterprise risk management. The committee consists of the Chief Executive Officer (CEO) and senior executives from all departments, excluding the Internal Audit Department, to ensure independence in the auditing process.

The Risk Management Committee has the following key responsibilities.

-

- Reviewing and mitigating risks to ensure that the core enterprise risks be regularly identified and evaluated. In addition, the Risk Management Committee will provide effective risk mitigation measures or plans to be able to achieve BPP’s goals, both in the short- and long term.

- Providing support relevant to policy to mitigate risks efficiently, ranging from the business unit level to the corporate strategy level.

- Supporting internal and external resources is necessary for efficient risks management.

- Creating awareness of risk management in all BPP’s business units and in the businesses in which BPP has invested.

- Reporting risk management results to the Audit Committee and the Board of Directors every quarter.

- Presenting the risk management policy, including setting up criteria for risk assessment.

BPP has announced its risk management policy and updated it regularly. The Sustainable Development and Risk Management Department was established with direct responsibility on coordinating with all departments and driving effective risk management throughout the organization. A mechanism to find out and identify key business risks covering the areas of ESG has been implemented, while the impact likelihoods to stakeholders have been assessed to consider their priorities prior to defining them as an enterprise risks list. The responsible person has also been assigned to mitigate risks

to be at the appetite level, including following up on risk mitigation progress and continuously reviewing risk issues.

Moreover, BPP has integrated the principle of risk management into various procedures within the organization to raise awareness of business uncertainties and promote risk management as part of its operations, in preparation for any events arisen in the future. Risk management is also a key factor in reviewing the core materiality and the annual operating plan.

Operating Mechanisms

For maximum efficiency on risk management, BPP has integrated risk management into its business strategic plan and operations, by applying risk correlation principles to analyze correlations of each risk in both positive and negative aspects. In addition, key risk issues have been used for assessing core sustainability materiality to manage such risks.

BPP’s risk management process begins with defining objectives according to the business plan and allocating them into the business

unit level. To identify risks, the operational level employees who have knowledge and expertise in each business unit will determine operational risks under his/her areas in detail. The likelihood and impacts of such risks will be assessed along with preparing practice guidelines to mitigate risks possibly arising. Then, the risk management results will be reported to his/ her supervisors and risk management manager to gather each business unit’s risks before submitting them to the Sustainable Development and Risk Management Department where all business unit risks are compiled into the enterprise-level risk report. The enterprise risk report will be quarterly presented to the Risk Management Committee, the Audit Committee, and the Executive Committee.

Additionally, the Risk Management Department will report the ESG associated risks to the ESG Committee to acknowledge and govern ESG risks. BPP has thoroughly assessed risks related to new business investments, both on investment returns and ESG issues of each new project. The risks assessment result and risks mitigation plan will be presented to the Investment Committee to ensure that risks related to BPP’s investments be assessed and managed properly.

Performance

- Deploying a risk management system covering all business units equivalent to 100%.

- Coverage ratio of risk management system associated with ESG issues was 98%.

- Assessing strategic risks for the 2030 strategic planning to make a prudential strategic plan with flexibility and meeting BPP’s long-term growth.

- Corruption risk assessment reports of each asset were compiled and reviewed, while guidelines for managing corruption risks were created in preparation for a renewal of the Private Sector Collective Action against Corruption (CAC) membership in the year 2025.

- The workshop to assess core materiality and corporate risk issues was organized.

- Arranging training on “ESG Risks and Trends in Power Business” for BPP’s Board of Directors, executives, and employees.

- Raising awareness related to risks and sustainability by summarizing business news and changes occurring around the world and communicating such news and movements to executives and employees across the organization every month.

Key Activities and Projects

Based on BPP’s risk assessment results, the following two issues have been identified as emerging risks or existing risks with significant changes:

1. Geo-Economic Confrontations Risks

In the previous year, geopolitical conflicts continued, while elections were held in many countries. The political tensions

in various regions were also more severe. These factors caused social divide, competition and polarization between superpowers, leading to more violent global geo-economic confrontations, which are expected to continue for many years to come. As a result, many countries are still facing increased challenges in economic cooperation. This affects the economic system or causes uncertainty in the economic direction, such as fluctuations in interest and exchange rates, an increase in inflation or higher energy prices, as well as governmental policy changes, etc. All these negative factors have a direct impact on business operations. Since BPP has operated businesses in many countries, it is inevitable to avoid such impacts. Moreover, it has business operations in distinct mighty nations, both China and the United States, which may be subject to trade or investment barriers. Subsequently, it will have a negative impact on generating income or growing the business as targeted. Other factors affecting BPP’s businesses include an investment uncertainty derived from interest rates, production costs, customers’ energy and electricity demand. As a result, BPP has given great importance to and be prepared for reducing such impacts as follows:

- Studying economic trends, monetary policy, and trade measures in the countries where BPP has invested to analyze investments and develop a business plan that accommodates uncertain situations while remaining

- Closely and regularly monitoring and analyzing significant global megatrends, such as technological advancements, market directions, and various related factors, to assess their impact on the business and long-term strategic plans.

- Establishing internal measures to enhance operational flexibility, enabling rapid adaptation to uncertain situations to ensure stability and security for BPP.

2. Risks of Misinformation and Disinformation

Nowadays, the use of digital technology, including artificial intelligence (AI), has become more widespread. AI has been applied to manage data, analyze, process, and build on further to benefit business in terms of management and marketing, including helping develop information and quickly reach many target groups. Sometimes media users or those involved may not check the facts, while bad people are trying to take advantage of such technology by intentionally distorting information and publishing such disinformation to cause damage to businesses or organizations. For example, spreading fake news about the environmental impacts of energy projects, making accusations about operations, or attacking one’s image through presenting false information on social media, etc. Using misinformation or disinformation is likely to continue in the future. Such a factor can affect BPP’s business operations, image, and credibility, such as losing trust from stakeholders, lacking confidence from investors, or affecting future business opportunities. If false information is not corrected quickly, it may make BPP face both financial and legal damages. As a result, BPP has given great importance to and be prepared for reducing such impacts as follows:

- Creating transparency and trustworthiness by continuously reporting or disclosing information related to ESG operations and operating results in reliable channels, such as annual reports, sustainable development (SD) reports, or BPP’s official website. This includes using/publishing information having accuracy verified by internal and external organizations.

- Creating clear communication channels and communicating them proactively by regularly publishing up-to-date operational results through BPP’s official website. This includes continuously monitoring BPP’s news from external media in order to be able to quickly respond to the dissemination of inaccurate information by other media. This can be done by publicizing accurate information through reliable channels.

- To prevent risks from using AI that may occur, Banpu Group has created a policy on the use of AI, using the policy as a guideline for applying AI in operations within the organization.

On 11 January 2024, BPP organized the Materiality Review & ESG Risks Workshop 2024 for its executives and employees.

The aim was to allow participants to jointly review key materiality related to BPP business. At the workshop, participants had a chance to discuss and give opinions on the ESG related trends and risks of the electricity business driven by both internal and external factors. Key materiality and risk issues were also used as data for assessment and management so as to help BPP in adapting itself and formulating strategies to appropriately respond to enterprise risks, both in the short- and long- terms.

BPP has placed great importance on environment, social, and corporate governance (ESG). It aims to create understanding and awareness of ESG risk management and set strategic directions to create sustainable growth.

In October 2024, BPP’s board of directors and involved employees attended the ESG Summit 2024 held by Banpu Group. The summit was attended by 142 people onsite and 216 people participating via online channels. The summit was focused on decarbonization, and using artificial intelligence (AI) for sustainability, including creating readiness for cyber security as well as personal data protection. At the event, executives, employees, and international consultants jointly exchanged their views.

In November 2024, BPP organized both on-site and online training on the topic of “ESG Risks and Trends in Power Business” for its board of directors, executives, and employees. External speakers from leading consulting firms were invited to give a lecture and provide knowledge about the use of artificial intelligence (AI) for sustainability in the electricity business (AI for Electricity Utilities Business and Sustainability), including examples of its use, such as: AI technology in the power business, Using AI to drive ESG operations, Risks arising from AI. The training made participants have a greater

understanding about AI and able to apply knowledge gained as a guideline for their work. This included setting up corporate strategic goals to help BPP conduct business and grow sustainably. Moreover, 85.7% of participants were satisfied with this training. They agreed that the training was able to increase their understanding regarding how to apply

AI for sustainability. Besides, they will have more awareness on the use of AI in the future.

Document Download

Banpu’s Group Information and Cybersecurity Policy

Appointment of Banpu Group’s Global Information Security Officer (GISO)

Risk Management Committee Charter

Risk Management Policy

Risk Appetite Policy