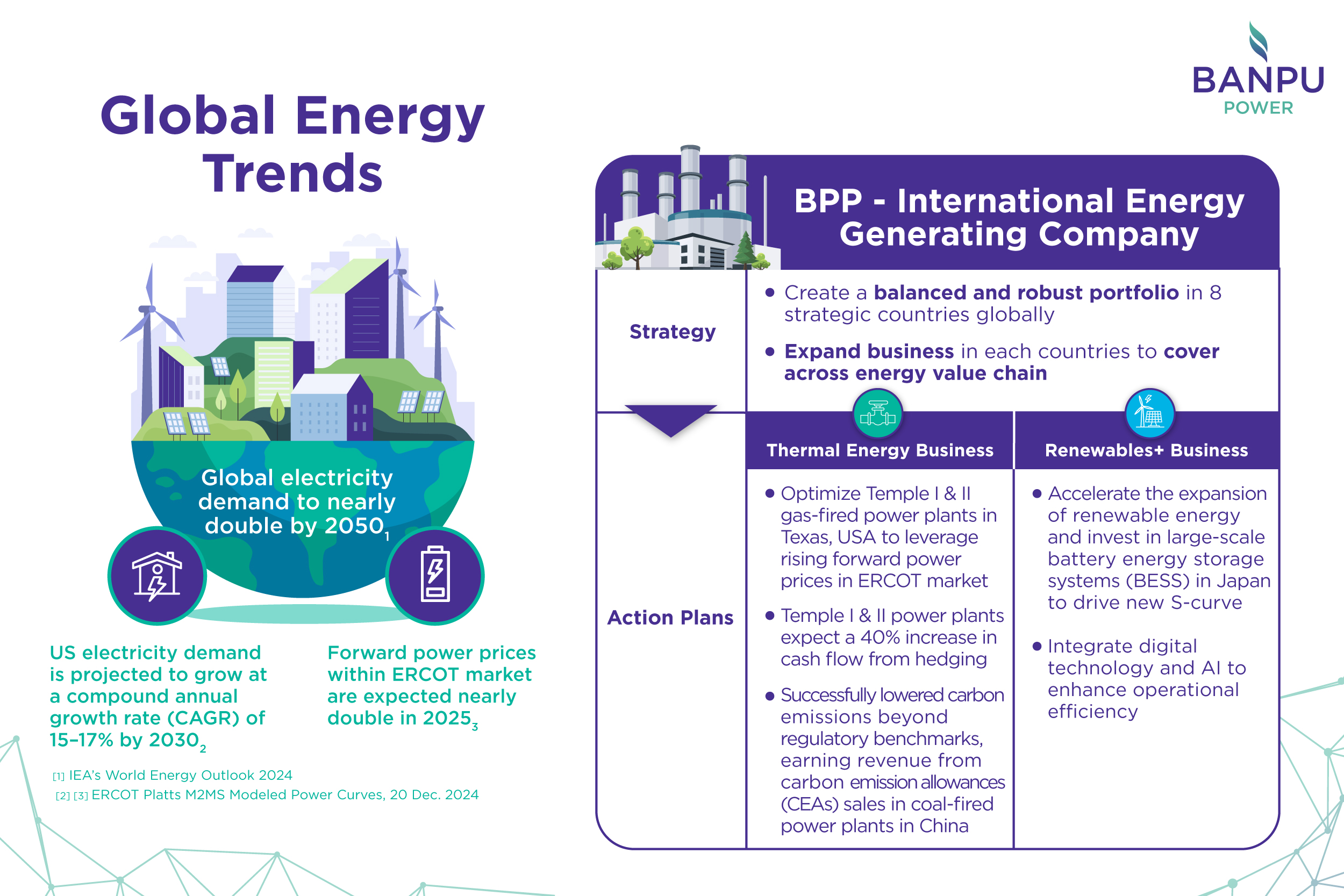

BPP Strengthens US Presence Amid Surging Demand and Nearly Doubled Forward Power Prices, While Gaining Additional Revenue from CEAs in China

Banpu Power PCL (BPP), an international energy generating company, reported solid performance for 2024, maintaining stable operations across all power plants while leveraging technology to reduce CO2 emissions. Notably, its power plants in China successfully lowered carbon emissions beyond regulatory benchmarks, generating additional revenue of nearly THB 90 million from the sale of carbon emission allowances (CEAs). Meanwhile, the company is preparing Temple I and Temple II gas-fired power plants in the US to capitalize on the strong upward trend in forward power prices within the ERCOT (Electric Reliability Council of Texas) market, which are expected to nearly double in 2025. Additionally, electricity demand in the US is projected to grow at a compound annual growth rate (CAGR) of 15–17% by 2030,1 driven by increased investment in data centers. Texas, in particular, ranks as the second-largest hub for data center expansion in the US.2

Mr. Issara Niropas, CEO of Banpu Power PCL (BPP), stated, “BPP continues to drive growth according to the ‘Beyond Quality Megawatts’ approach, prioritizing a balanced and robust portfolio that goes beyond power generation capacity expansion. This approach enhances the company’s flexibility in identifying new growth opportunities while ensuring stable long-term cash flow. Over the past year, our gas-fired power plants, Temple I and Temple II in Texas, USA, have maintained consistent operations, despite lower average electricity prices due to unfavorable temperature and weather conditions compared to the previous year. However, we anticipate power prices to rise in 2025, in line with the evolving energy tech landscape and increasing electricity demand in the US. Furthermore, BPP has implemented hedging risk management measures using financial derivatives for both power plants. In 2025, the company expects a 40% increase in cash flow from these measures compared to 2024. Additionally, we see significant revenue potential in China from the CEAs trading in our coal-fired power plants.”

“In parallel, BPP is accelerating the expansion of its renewable energy and other energy-related businesses (Renewables+), reinforcing its energy value chain through strategic investments in large-scale battery energy storage systems (BESS) and energy trading. These initiatives will drive the company’s ‘new S-curve’ growth while integrating digital technology and AI to enhance operational efficiency,” Mr. Issara added.

In 2024, BPP reported total revenue of 25,827 million baht and a net profit of 1,746 million baht, with EBITDA (earnings before interest, taxes, depreciation, and amortization) from normal operations reaching 7,383 million baht. The company maintained a low debt-to-equity (D/E) ratio of only 0.49x. Key business highlights for the year include:

- Thermal Energy Business: The HPC power plant in Lao PDR and the BLCP power plant in Thailand continued to operate efficiently, maintaining high equivalent availability factor (EAF) of 86% and 90%, Both plants supplied additional electricity outside of their contracted availability hours (CAH) as they completed dispatch ahead of schedule, contributing to the country’s energy security. Additionally, operational performance improved at combined heat and power (CHP) plants and the Shanxi Lu Guang (SLG) power plant in China, benefiting from improved coal cost management and additional revenue of nearly 90 million baht from the sale of approximately 290,000 tCO2e of CEAs, marking a record high. This reflects BPP’s effective carbon management and its ability to outperform regulatory benchmarks.

- Renewables+ Business: The company expanded its BESS portfolio with two new projects in Japan, Aizu and Tsuno, with a combined storage capacity of 208 megawatt-hours, expected to achieve commercial operation date (COD) in Meanwhile, the Iwate Tono BESS project (58 megawatt-hours) is now 99% complete and set for COD in Q2 2025. In energy trading, BPP successfully executed 2,816 gigawatt-hours of transactions in Japan in 2024, achieving outstanding performance. Additionally, in 2025, Banpu NEXT, in which BPP holds a 50% stake, entered a joint venture with SolarBK, a leading clean energy company in Vietnam. The partnership aims to expand solar rooftop solutions for commercial and industrial sectors, with an initial Phase 1 target of 390 megawatts.

“BPP’s well-diversified and strategically balanced portfolio across eight markets worldwide provides resilience against global uncertainties while reinforcing our competitive advantage in each region. This enables us to consistently deliver value and strong returns to stakeholders while advancing towards our vision of becoming an international energy generating company,” Mr. Issara concluded.

[1] Platts M2MS Modeled Power Curves for ERCOT, as of 20 December 2024

[2] JLL, ERCOT

Learn more about BPP’s businesses at www.banpupower.com.

###

About BPP

Banpu Power Public Company Limited (BPP), an international quality power generating company, is committed to delivering sustainable energy through its aim of “Powering Society with Quality Megawatts.” The Company generates and distributes power in the Asia-Pacific region, including Thailand, Laos, China, Japan, Vietnam, Indonesia, Australia and the U.S. For almost three decades, BPP has been committed to operational excellence to achieve efficient power generation while deploying high-efficiency, low-emissions (HELE) technologies that prioritize safety and environmental sustainability.