BPP Thrives in the US by Acquiring Twin Power Plants – Temple l & Temple ll to Enhance its Business Value Chain

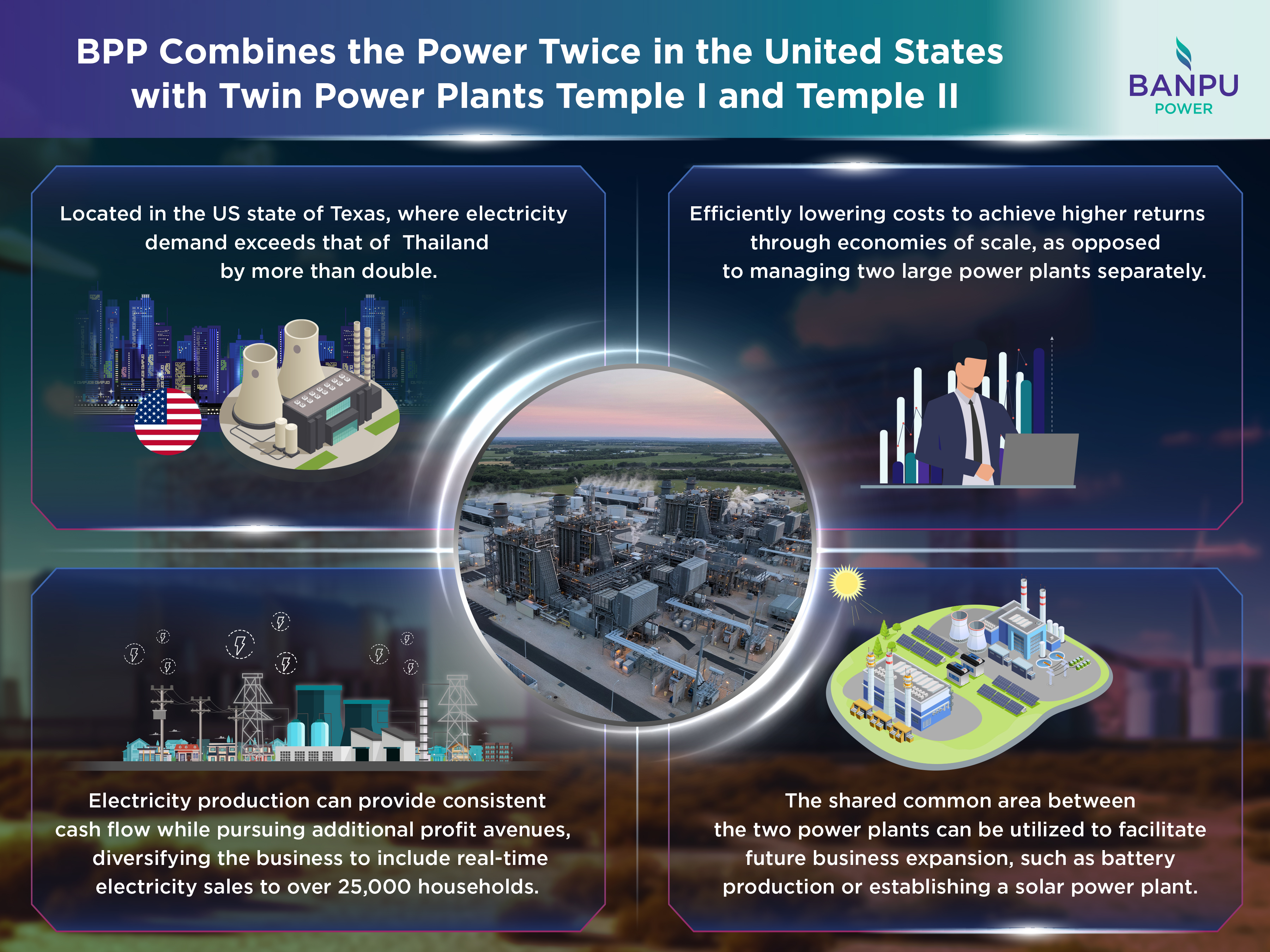

The United States always comes to mind when discussing countries with robust economic growth and the highest rates of electricity consumption globally. In the state of Texas alone, home to approximately 30 million residents, the demand for electricity exceeds that of Thailand by nearly double. This translates into numerous opportunities for manufacturers requiring the presence of producers with the capacity to adequately meet this substantial electricity demand. Recently, Banpu Power Public Company Limited (BPP), an international quality power generating company, expanded its operations in Texas. In 2021, the Company-initiated operations at the Temple I gas-fired power plant, and subsequently invested in the Temple II gas-fired power plant located in the same vicinity. With a substantial power generation facility, this strategic move solidified BPP’s position by offering a combined capacity of approximately 1,500 megawatts. These facilities utilize state-of-the-art Combined Cycle Gas Turbines (CCGT) technology, known for their modernity and high efficiency, and marked a pivotal milestone for BPP’s growth trajectory and enhanced potential to generate long-term profits from power plants that employ environmentally friendly technologies, adhering to the Company’s High Efficiency, Low Emissions (HELE) principles and “Greener & Smarter” strategy.

“As a result of BPP’s investment in the Temple I Power Plant, we conducted an in-depth analysis of the electricity market in Texas. Our findings revealed the considerable market potential and substantial demand for electricity in the state. During peak periods, demand can soar to an impressive 84,000 megawatts, in contrast to Thailand’s demand of approximately 34,000 megawatts. Despite having half the population of Thailand, Texas consumes twice as much electricity. Recognizing this important opportunity, BPP has strategically planned additional investments in the same location. The introduction of the Temple II Power plant not only adds more megawatts to BPP’s portfolio but also capitalizes on the strategic proximity of the two plants, which translates into a streamlined business operation, leading to lower costs per unit and higher returns through economies of scale (EOS). By combining production capacity, we effectively double our output while improving operational efficiency and cost management through shared resources and knowledge. Additionally, consolidating the management of both power plants substantially reduces administrative costs. For instance, we can establish a dedicated full-time team to oversee the combined operations or share maintenance machinery and backup equipment, further optimizing operational efficiency. In additional, the shared common area between the two plants offers ample opportunities for future expansion, such as venturing into battery production or establishing a solar power plant. Our acquisition of the Temple II power plant coincided with preparations for the summer season, often referred to as the high-demand season for electricity. Similar to previous years, electricity consumption in the Electric Reliability Council of Texas (ERCOT) market during other seasons hovers around 100 million megawatt-hours. However, during the summer season, this figure surges to 130 million megawatt-hours, marking an increase of over seven percent. The heightened demand for electricity during this period presents a lucrative opportunity to increase our profitability,” said Pattanasak Naksorn, Manager-Strategy and Business Development, who oversees BPP’s business development in the United States.

Since assuming management control of the Temple I and Temple II power plants, BPP has implemented three key initiatives aimed at enhancing both managerial prospects and profitability at both power plants: 1. Operational Excellence: BPP has prioritized the development of adaptable operational plans tailored to diverse circumstances, ensuring efficient operations for the power plants; 2. Strategic Trading Approach: A comprehensive electricity trading strategy was introduced, emphasizing the optimization of trading prices to generate added value for the business; and 3. Hedging and Risk Management: BPP established robust risk mitigation and management strategies, utilizing a range of financial tools to ensure consistent cash flow. Both power plants are strategically located between Austin and Dallas, benefiting from the large population and business density in these regions. This prime location enables the effective support of electricity demand. Notably, the electricity market in Texas is overseen by ERCOT, a non-profit organization, which operates the state’s electricity independently within the thriving and fully competitive merchant power market, one of the fastest growing in the United States. As a result, the business prospects extend beyond just power generation and sales.

“BPP has strategically planned its operations for both power plants to ensure flexibility and synergies, improving overall efficiency and revenues. Our goal is to provide stable cash flow by supplying power to one plant as a base load during periods of high demand. Simultaneously, the other power plant can leverage excess electricity production to explore additional profit avenues in the real-time electricity trading market, catering to household (or retail) customers. At present, we have successfully commenced selling electricity to approximately 25,000 households and envision further expansion. Being both electricity producers and sellers empowers us to manage various crucial factors, while minimizing potential risks. This includes enhancing our bargaining power due to increased production volumes, optimizing production levels, and setting competitive pricing based on market supply and demand dynamics. Additionally, we can guarantee reliable electricity delivery to our customers. These strategic steps mark a significant milestone in BPP’s journey, as we expand and reinforce our position within the US electricity business value chain, embracing emerging opportunities that may arise in the future,” added Pattanasak.

When entering a new business, BPP is focused on synergies with its value chain, and the US market stands out as a strategic focal point for the Company’s future business growth endeavors in terms of doubling production capacity, improving efficiency, and reinvigorating resources.

Kirana Limpaphayom, Chief Executive Officer of BPP, emphasized this achievement, stating, “The acquisition of the Temple I and Temple II power plants underscores BPP’s unwavering commitment to creating a comprehensive and robust electricity business ecosystem. We possess the expertise to manage large HELE power plants, complemented by a deep understanding of the intricacies of the US electricity market. Our strategic focus encompasses meticulous production and power distribution planning, along with efficient electricity trading between these two power plants, achieving synergies to boost efficiency, maximize profitability, and generate increased cash flow for the Company.”

Learn more about the BPP business at www.banpupower.com

###

About BPP

Banpu Power Public Company Limited (BPP), an international quality power generating company, is committed to delivering sustainable energy through its concept “Powering Energy Sustainability with Quality Megawatts.” The Company generates and distributes power in the Asia-Pacific region, including Thailand, Laos, China, Japan, Vietnam, Indonesia, Australia, and the U.S. For almost three decades, BPP has been committed to operational excellence to achieve efficient power generation while deploying high-efficiency, low-emissions (HELE) technologies that are safe and environmentally sound in accordance with its Greener & Smarter strategy. The Company is continuously moving forward to reach a total equity-based power generation capacity of 5,300 MW within 2025.